In an era where efficiency and convenience are paramount, Chase Bank’s direct deposit service stands out as a fundamental tool for managing personal finances. By utilizing a Chase Direct Deposit Form, customers can streamline their financial transactions, ensuring timely and secure deposits directly into their bank accounts. This service is particularly beneficial for employees, retirees, and anyone receiving regular payments, offering numerous advantages over traditional banking methods.

What is a Direct Deposit?

Direct deposit is an electronic payment method that allows funds to be transferred directly into a bank account without the need for physical checks. This method is commonly used for payroll, government benefits, tax refunds, and other recurring payments. By opting for direct deposit, individuals can enjoy faster access to their funds, reduce the risk of lost or stolen checks, and avoid the hassle of manual deposits.

Benefits of Using Chase Direct Deposit

1. Convenience and Time-Saving: One of the primary benefits of direct deposit is convenience. Once set up, payments are automatically deposited into your Chase bank account on the scheduled date. This eliminates the need to visit a bank branch, stand in line, or deposit checks manually, saving valuable time and effort.

2. Reliability and Security: Direct deposit is a secure method of transferring funds. Since the process is electronic, there is no risk of checks being lost, stolen, or damaged. Chase employs robust encryption and security measures to protect your financial information, ensuring that your funds are safely deposited.

3. Immediate Access to Funds: With direct deposit, funds are available immediately on the day of deposit. This is especially advantageous for individuals who rely on timely payments for budgeting and financial planning. Unlike physical checks, which may take several days to clear, direct deposits are processed instantly.

4. Environmentally Friendly: By opting for direct deposit, you contribute to reducing paper waste and the environmental impact associated with printing and transporting checks. This eco-friendly choice aligns with sustainable banking practices and helps promote a greener future.

How to Set Up Direct Deposit with Chase

Setting up direct deposit with Chase is a straightforward process that involves completing a direct deposit form and submitting it to your employer or payment provider. Here’s a step-by-step guide:

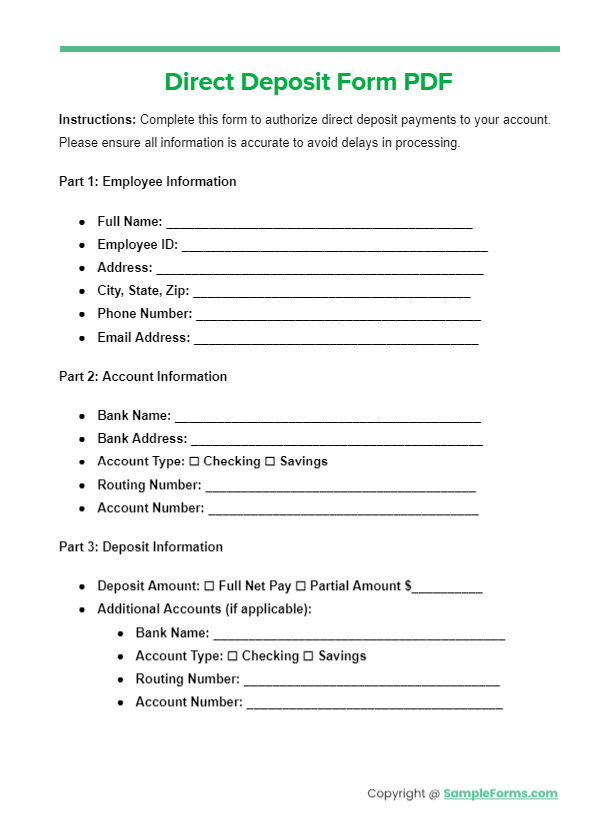

1. Obtain a Direct Deposit Form: You can obtain a Chase Direct Deposit Form from your local branch, the Chase website, or through the Chase mobile app. The form is also available in the payroll or HR department of many employers.

2. Provide Required Information: Fill out the direct deposit form with your personal information, including your name, address, and Social Security number. You will also need to provide your Chase account number and the bank’s routing number, which can be found on your checks or by contacting Chase customer service.

3. Specify Deposit Amounts: If you want your payments to be divided between multiple accounts (e.g., checking and savings), specify the amounts or percentages for each account on the form.

4. Submit the Form: Submit the completed direct deposit form to your employer’s payroll department or the organization issuing your payments. Some employers may also allow you to set up direct deposits online through their employee portal.

5. Verify Deposits: Once the form is processed, verify that your payments are being deposited correctly into your Chase account. This may involve monitoring your account for the first deposit or checking with your payroll department to confirm the setup.

Additional Features and Considerations

Chase’s direct deposit service also integrates seamlessly with other banking features. For example, customers can set up automatic transfers from their checking account to their savings account, making it easier to save money regularly. Additionally, direct deposit can be paired with Chase’s mobile banking app, allowing users to track deposits and manage their finances on the go.

For those receiving government benefits or tax refunds, direct deposit is often the preferred method due to its reliability and speed. Many government agencies and tax authorities encourage the use of direct deposit to expedite payments and reduce administrative costs.

Conclusion

The Chase Direct Deposit Form is a powerful tool that simplifies financial transactions, providing a secure, convenient, and efficient way to manage your income. By setting up direct deposit, you gain immediate access to your funds, reduce the risks associated with physical checks, and contribute to environmentally friendly banking practices. Whether you’re an employee, retiree, or receiving regular payments, Chase’s direct deposit service is an invaluable asset for modern financial management.