In the world of investment, generating steady income while minimizing risk is a goal for many investors. One of the financial instruments that has gained popularity for achieving this balance is the JPMorgan Equity Premium Income ETF, commonly known by its ticker symbol, JEPI. This exchange-traded fund (ETF) offers investors the potential for attractive dividends alongside exposure to a diverse portfolio of equities. This article delves into the structure, performance, and benefits of JEPI, and why it might be a valuable addition to an income-focused investment strategy.

The Structure of JEPI

JEPI is an actively managed ETF designed to provide high monthly income by investing in a diversified portfolio of large-cap U.S. stocks and utilizing options strategies. Here are the key components that define JEPI:

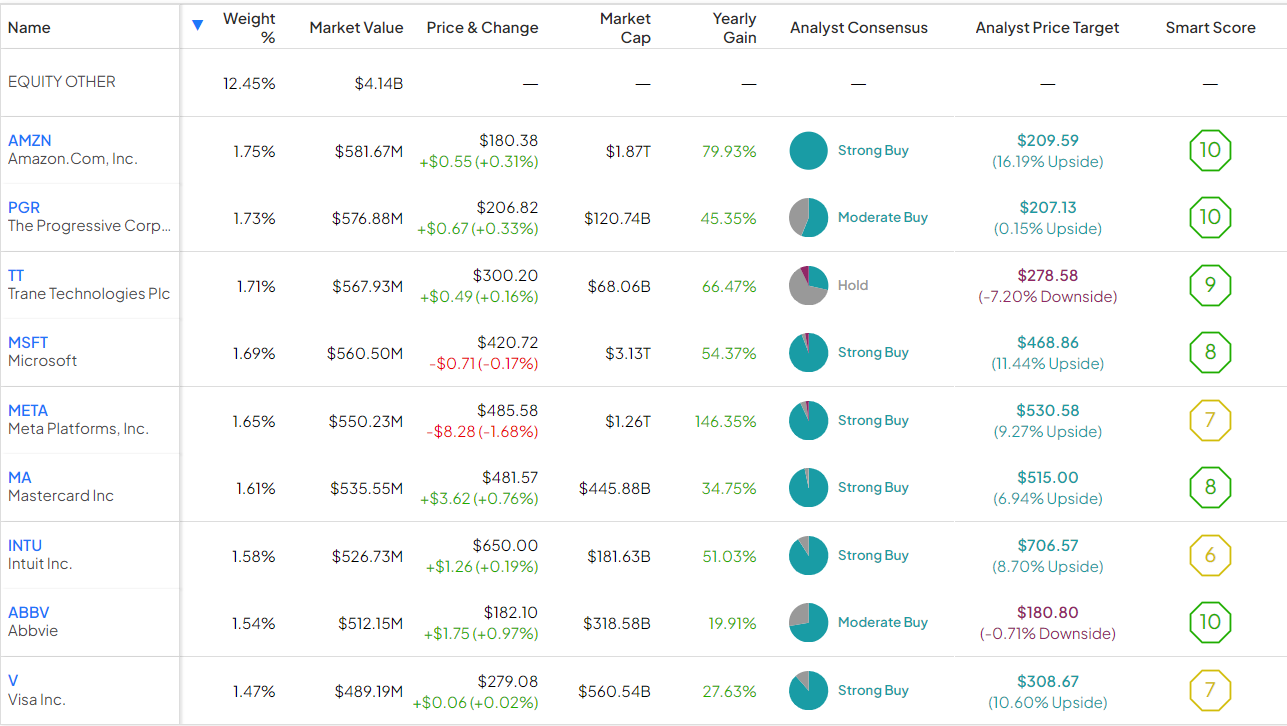

- Equity Portfolio: The core of JEPI’s portfolio consists of high-quality, low-volatility U.S. large-cap stocks. This includes well-known companies with strong fundamentals and stable earnings, which form the foundation of the ETF’s investment strategy.

- Options Overlay Strategy: What sets JEPI apart from many other dividend-focused funds is its use of an options overlay strategy. The fund sells call options on a portion of its equity holdings, generating additional income through premiums. This strategy aims to enhance the overall yield while providing some downside protection in volatile markets.

- Active Management: Unlike passive index funds, JEPI is actively managed. This means that fund managers actively select and adjust the portfolio’s holdings and options positions based on market conditions and their investment outlook.

Performance and Dividend Yield

JEPI’s primary appeal lies in its ability to deliver a high dividend yield while maintaining exposure to the equity market. Here’s a look at its performance and yield characteristics:

- High Monthly Dividends: JEPI is known for its attractive monthly dividend payouts. The income generated from dividends and the options premiums is distributed to investors regularly, making it an appealing choice for those seeking consistent income.

- Competitive Yield: As of the latest data, JEPI offers a dividend yield significantly higher than the average yield of the S&P 500. This high yield is a result of the combined income from the underlying stock dividends and the options strategy.

- Performance Metrics: JEPI’s performance has been competitive, with returns that align closely with, or sometimes exceed, those of other high-yield income-focused funds. The fund’s active management and diversified approach help it navigate different market environments effectively.

Benefits of Investing in JEPI

Investing in JEPI comes with several benefits that make it a compelling option for income-focused investors:

- Consistent Income: JEPI’s high monthly dividends provide a reliable source of income, which is particularly beneficial for retirees or those looking to supplement their earnings.

- Diversification: The fund’s diversified portfolio of large-cap stocks reduces the risk associated with investing in individual equities. This diversification helps mitigate potential losses during market downturns.

- Downside Protection: The options overlay strategy not only generates additional income but also offers a layer of downside protection. By selling call options, JEPI can offset some of the losses when equity prices decline.

- Professional Management: Active management allows the fund to respond to changing market conditions and make informed investment decisions. This can be advantageous in volatile or uncertain market environments.

Considerations and Risks

While JEPI offers numerous advantages, it’s important for investors to be aware of potential risks:

- Market Risk: As an equity-focused ETF, JEPI is subject to market risk. The value of the fund’s holdings can fluctuate based on broader market movements.

- Options Risk: The use of options strategies introduces additional risks, including the potential for reduced upside in strong bull markets and the complexity of managing options positions.

- Management Risk: As an actively managed fund, JEPI’s performance is dependent on the skill and decisions of its management team.

Conclusion

JEPI stands out as a high-yield dividend ETF that combines the stability of large-cap equities with the income-generating potential of options strategies. Its ability to deliver consistent monthly dividends, coupled with active management and a diversified portfolio, makes it an attractive choice for income-focused investors. However, as with any investment, it’s essential to consider the associated risks and ensure that JEPI aligns with your overall investment objectives and risk tolerance. For those seeking a reliable income stream in the form of dividends, JEPI offers a compelling solution in the ever-evolving landscape of financial markets.