AMC Entertainment Holdings, Inc. (NYSE: AMC) has been a significant player in the stock market, often grabbing headlines due to its dramatic price swings and the vibrant community of retail investors that back it. Over the past few years, AMC’s stock has become synonymous with volatility, driven by a mixture of company fundamentals, market sentiment, and broader economic factors. This article delves into the recent trends surrounding AMC stock, analyzing its performance, key drivers, and what the future might hold for this cinema giant.

Recent Performance

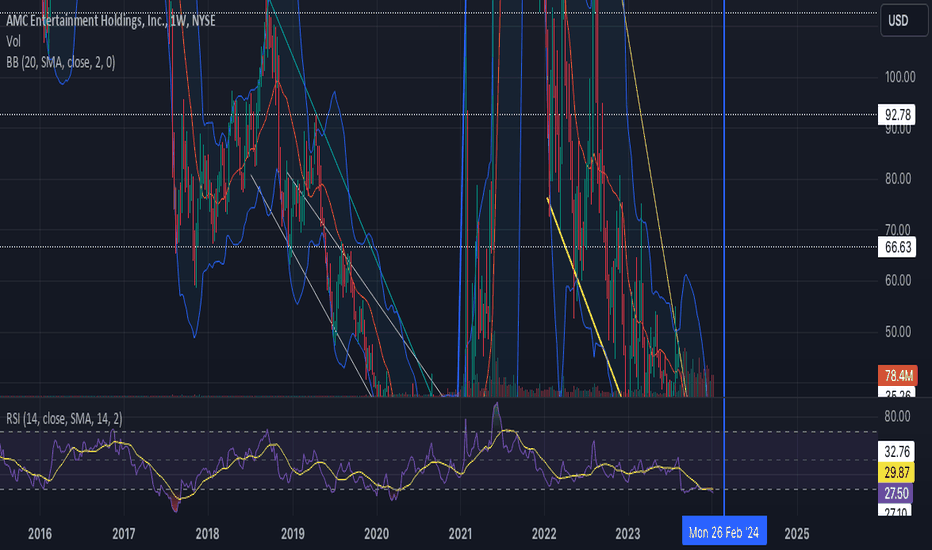

AMC’s stock has experienced considerable fluctuations recently. After a substantial rally in early 2021, fueled by retail investors on forums like Reddit’s WallStreetBets, AMC saw its share price skyrocket to unprecedented levels. The stock, which had traded around $2 per share in early 2020, reached a peak of over $70 in June 2021. This surge was driven by a combination of factors, including a short squeeze and a fervent community of retail investors aiming to disrupt traditional financial institutions.

Since then, AMC’s stock has corrected significantly. As of mid-2024, the stock trades in a range that is significantly lower than its 2021 highs, though it remains volatile. The price has been influenced by various factors, including fluctuations in box office revenues, shifts in consumer behavior, and broader market conditions.

Key Drivers

- Box Office Performance

One of the primary drivers of AMC’s stock performance is its box office revenue. With the reopening of theaters post-pandemic, AMC has faced both opportunities and challenges. Blockbuster releases and strong box office performances can drive up AMC’s revenue, positively impacting its stock. However, the rise of streaming platforms and changing consumer preferences have created headwinds. The company’s ability to adapt and attract audiences back to theaters is crucial for its financial health.

- Financial Health and Debt

AMC’s financial health remains a critical concern. The company has historically been burdened with substantial debt, a legacy of its aggressive expansion and the financial pressures of the pandemic. Efforts to restructure debt and raise capital have been ongoing. While AMC has managed to secure financing and reduce some debt, its financial stability is still a point of concern for investors. The company’s ability to manage its debt load while investing in growth opportunities is a key factor influencing its stock price.

- Market Sentiment and Retail Investors

The influence of retail investors cannot be overstated. The AMC stock phenomenon has demonstrated the power of collective action by individual investors. Social media platforms and online forums have played a significant role in driving AMC’s stock price, creating a unique market dynamic. While this can lead to significant short-term price movements, it also introduces a high level of unpredictability. Investor sentiment, driven by both news and social media buzz, continues to be a major factor in AMC’s stock performance.

- Economic and Market Conditions

Broader economic conditions also impact AMC’s stock. Interest rates, inflation, and overall market sentiment can affect investor behavior and market dynamics. For instance, economic uncertainty or changes in consumer spending habits can influence AMC’s stock performance. Additionally, macroeconomic trends and global events, such as geopolitical tensions or pandemics, can have an indirect effect on the stock.

Looking Ahead

The future of AMC stock is uncertain and depends on several factors. For investors considering AMC, it is essential to monitor the following aspects:

- Theatrical Industry Trends

The long-term success of AMC will depend on the recovery and growth of the theatrical industry. Key indicators to watch include box office trends, the success of major film releases, and consumer attendance patterns.

- Financial Management

Investors should keep an eye on AMC’s financial health, including its debt management, revenue growth, and profitability. Effective financial management will be crucial in determining the company’s ability to thrive in a competitive environment.

- Retail Investor Activity

Given the role of retail investors in AMC’s stock movements, staying updated on market sentiment and social media trends can provide insights into potential short-term price fluctuations.

- Economic Conditions

Broader economic conditions will continue to impact AMC’s stock. Monitoring economic indicators and market trends will help in assessing potential risks and opportunities.

Conclusion

AMC stock remains a compelling and unpredictable investment, characterized by significant volatility and influenced by a unique combination of factors. Recent trends highlight the importance of staying informed about industry developments, financial health, and market sentiment. As the company navigates a complex landscape, both opportunities and risks abound for investors. While AMC’s stock might continue to experience fluctuations, understanding these dynamics can help investors make more informed decisions.